LILAC Document Help

Finalise Deposit

Purpose: This document is used in conjunction with the Debtors Receipt document.

Each cheque received from a debtor is processed individually with comprehensive open-item "tick-off" of invoices automated by the Debtors Receipt program. Each cheque is reflected as a credit to the appropriate debtors account, and a corresponding debit is posted to the BALANCE DEPOSITS account for each cheque. At the end of the days banking the Bank Deposit Report is printed out and used as a cheque listing for reconciliation purposes and to send to the bank.

The purpose of the Finalise Deposit function is to create a debit on the BALANCE CASH AT BANK account and a credit on the BALANCE DEPOSITS account such that the DEPOSITS account is reduced to zero and there is a single entry on the CASH AT BANK account reflecting the day's banking.

Each cheque received from a debtor is processed individually with comprehensive open-item "tick-off" of invoices automated by the Debtors Receipt program. Each cheque is reflected as a credit to the appropriate debtors account, and a corresponding debit is posted to the BALANCE DEPOSITS account for each cheque. At the end of the days banking the Bank Deposit Report is printed out and used as a cheque listing for reconciliation purposes and to send to the bank.

The purpose of the Finalise Deposit function is to create a debit on the BALANCE CASH AT BANK account and a credit on the BALANCE DEPOSITS account such that the DEPOSITS account is reduced to zero and there is a single entry on the CASH AT BANK account reflecting the day's banking.

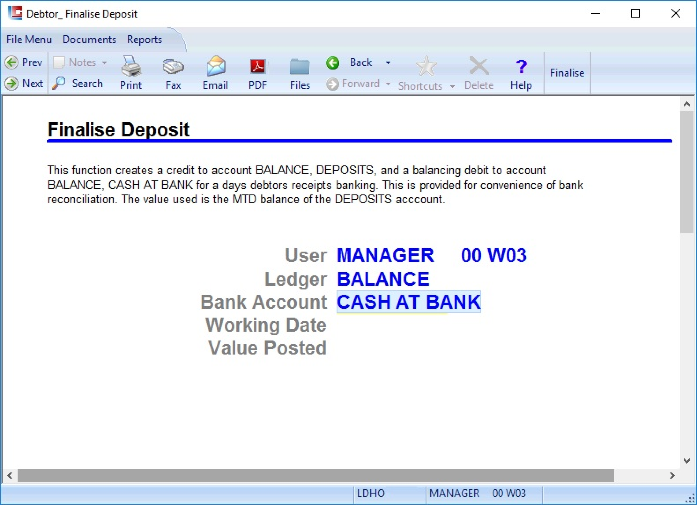

1. Select the bank account to which you want to debit the total deposit.

2. Click the 'Finalise' button to proceed. This will generate a figure in the 'Value Posted' field. This is based on the month to date balance of the DEPOSITS account.